If you follow our blog you might remember a blog entitled “How to Lose $50” that I wrote back in December of 2011. It basically chronicalled my really bad attempts to beat the stock market. I had taken $200 dollars of my money and lost $50 of it almost immediately.I (John) was about to throw in the towel, but I decided to go crazy and I continued to forge ahead. I kind of wanted to do a follow-up on what happened to those stock trades.

Well, this is how it went down… After about another 6 months FORD (Forward Industries) continued up, but it never broke the $2.00 mark. At a cost per share of $4.48 I got the impression I was never going to get my money back. It took some pride but I ended up cutting my losses at 50% and sold out the share. I was down another $50 dollars. F went all the way down to $10 a share and at one point I was looking at a 40% loss, but for some reason I just knew I couldn’t sell and so I didn’t. Then there was CALAMP.

Like FORD, CALAMP was also stagnant. Again I was down in the market, but I had done my research on CALAMP and I was convinced it was coming back. It was slow at first, a contract, a new order for goods, a bid for services. Then the federal contract kicked in and BOOM! It was off to the races! CALAMP shot up like a super star and I ended up selling the stock out for $16 a share. With some insurance and selling costs I ended up with a 160% profit.

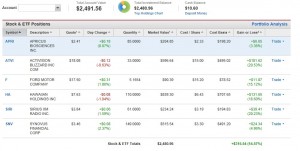

The stocks continue on the move. I have made some money and I have lost some money. I am using a mix of capital from my personal savings and business profit to continue to grow my portfolio. I happy to say I am now up to $2,491 dollars (12 times my orignal $200). If you look at the chart you can see that I still have F (Ford Motors) in portfolio, but it is a little bit bigger thanks to nice dividends and a soaring stock price. I still think this stock has more room to grow. I think Ford has gotten away from it’s exposure to Europe and in China is buying Ford Focuses like there is no tomorrow.

The stock portfolio I have is definetely growing. I pick in companies I believe in and I love the diversity I currently have in my stocks. I have a biomedical company, APRI (Apricus). Not only do I play video games, I own a video game company (ATVI). I like music on the go so I bought into SIRI (Sirius). I see a trend in Asia so I bought into Hawaiian Holdings (HA). I also believe the south is coming back and so I invested in Synovus Financial (SNV).

I also have a few more tricks up my sleeve. I just got my application for options trading approved and I have (what I think is a great idea) for my first options trade. I would share it on this blog, but I that would kind of defeat the purpose of an options trade. Which brings me a to my next point… WARNING: I am not a financial advisor. I still consider myself a beginner when it comes to trading stock and by no means would want any of my words to be interpreted as financial advise. Do not try to follow me in my stock trades. This is also not my retirement plan, I have a completely different account setup for that (which is also doing well).

I am only writting about my stocks to hope inspire someone to find their own way. Investing in stocks has taught me that sometimes it is good to cut your losses and sometime it is good to press on. Finding that balance is the key to a successful life. The journey continues. Where it stops I have no idea, but I know if I want it enough I will find a way to accomplish it.